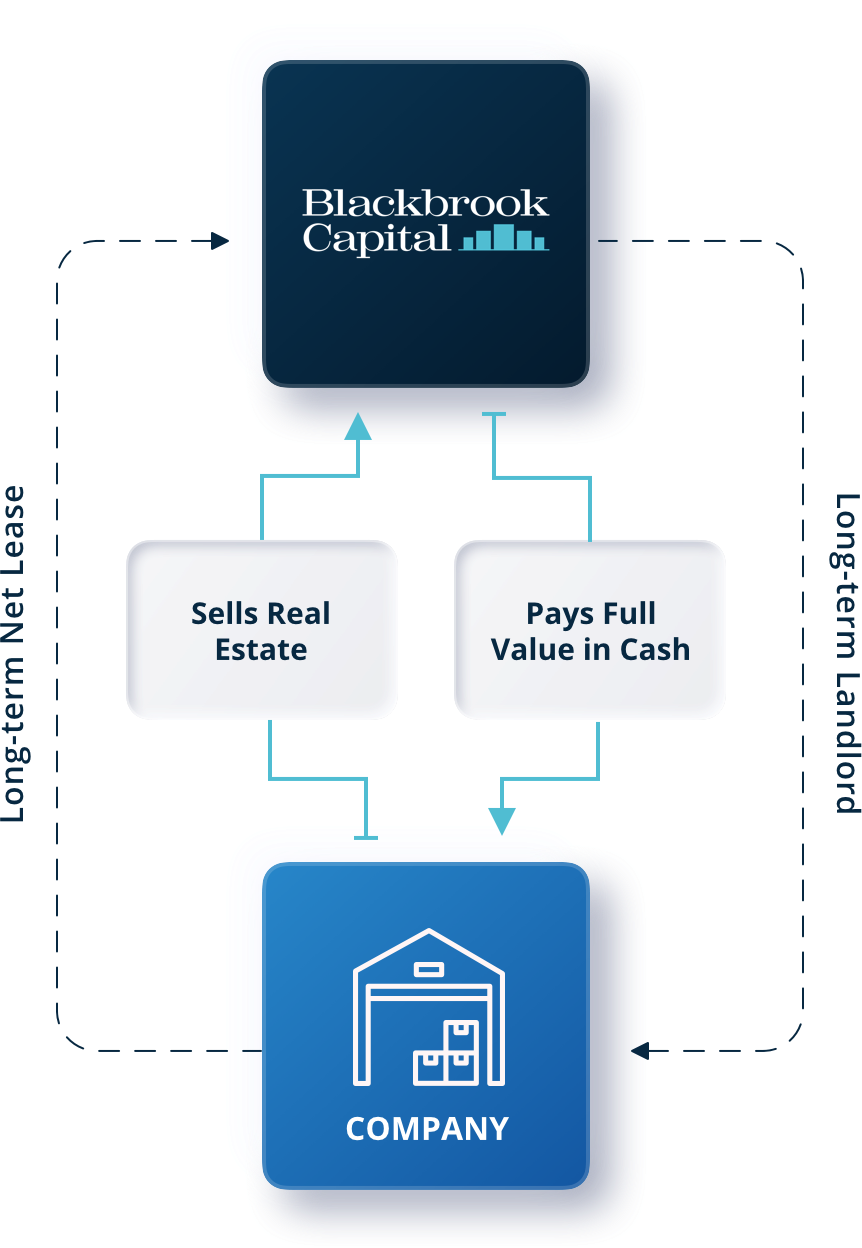

Sale-Leaseback Transactions

Unlock growth capital: We are experts in structuring sustainable Sale-Leaseback solutions for companies of all sizes, both investment and sub-investment grade, public and private, and across multiple industries.

Redeploy capital for growth: Through structuring a Sale-Leaseback with Blackbrook Capital, companies are able to release capital tied up in the real estate assets and redeploy that capital into their core operating businesses, recapitalise their balance sheets and fund M&A, sustainability and growth initiatives.

Retain control: At the same time, our tenants retain full operational control of their critical properties for the long term while having the security of a capital partner for future investments in the properties to help drive further growth.

Plan for a greener future: Blackbrook helps businesses transition their real estate footprint towards a greener and more sustainable future through specialist ESG initiatives.

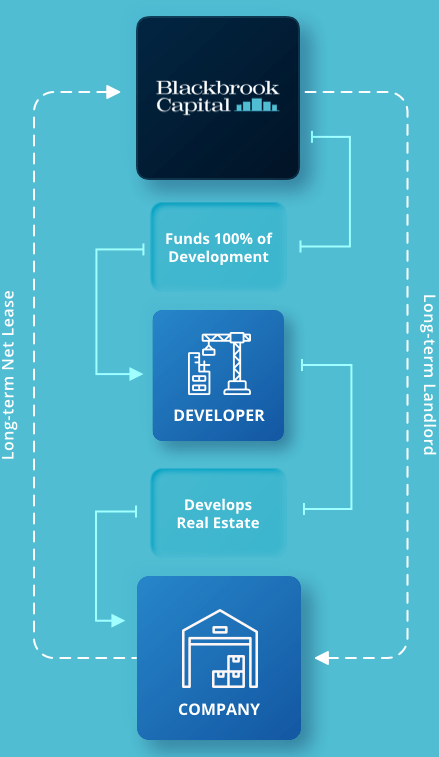

Build to Suit Financing

Access 100% funding for Build to Suit commercial development

We can fund 100% of the construction and development cost of new mission-critical real estate required for business growth.

We partner with professional developers and real estate occupiers to structure highly efficient development funding for Build to Suit commercial properties.

This allows developers and occupiers to ensure their capital is used more effectively in their core operating business, while at the same time securing the properties they need in a timely and transparent fashion.

This can be structured either as forward funding (fund-through) development financing or as a forward commitment (purchase upon completion).

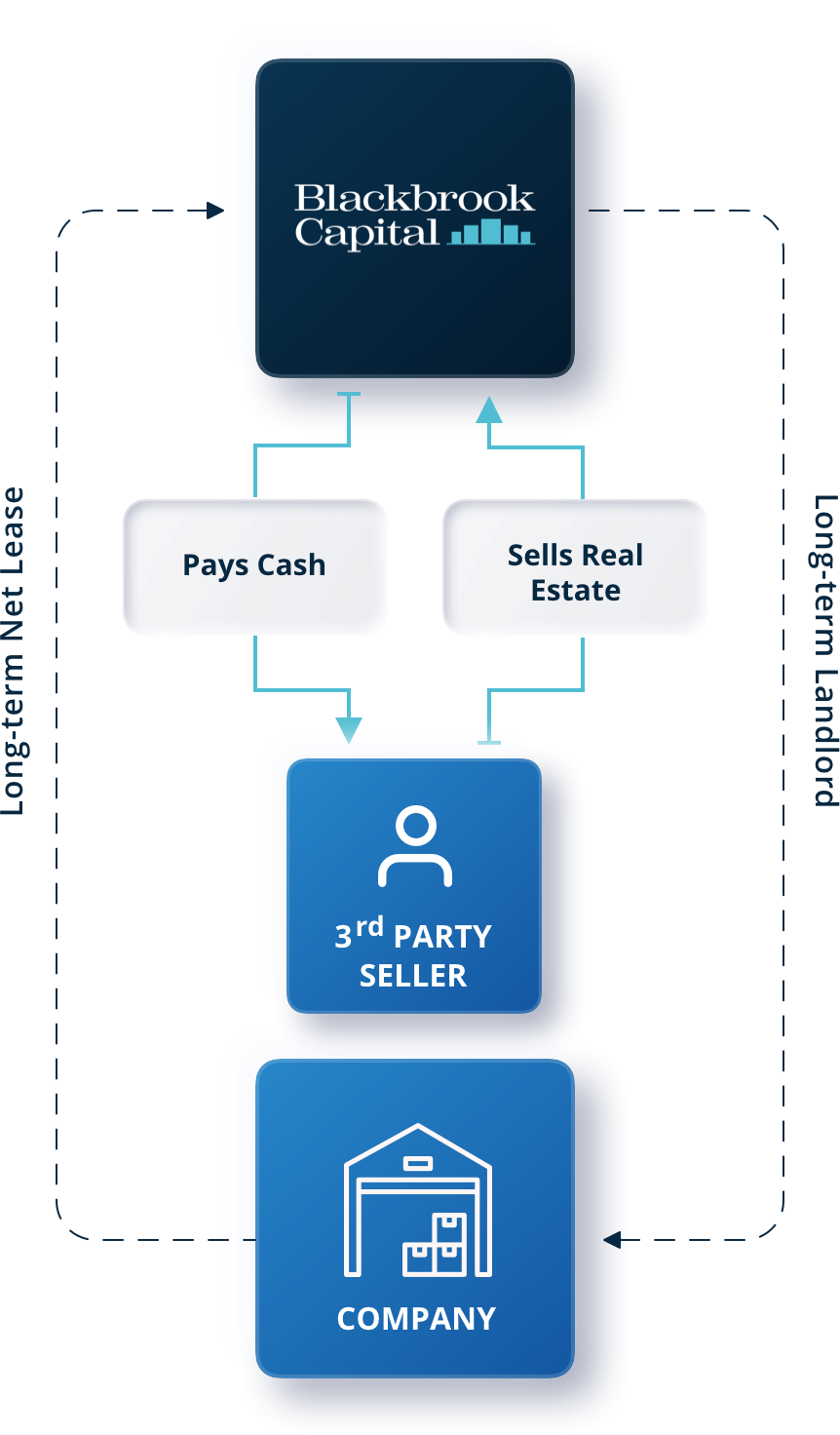

Net Lease Real Estate

Realise value in your properties

Blackbrook Capital invests in single-tenant “Net Lease” (triple-net, FRI, Dach und Fach) or “long-income” commercial real estate assets where we see long-term value in the property and in developing a partnership with the occupier.

Our primary focus is real estate where we believe that we can provide Value-Add for the assets in question, such as through green & energy efficiency improvement initiatives, and expansion financing to ensure our properties are both cost effective for our tenants and environmentally sustainable.

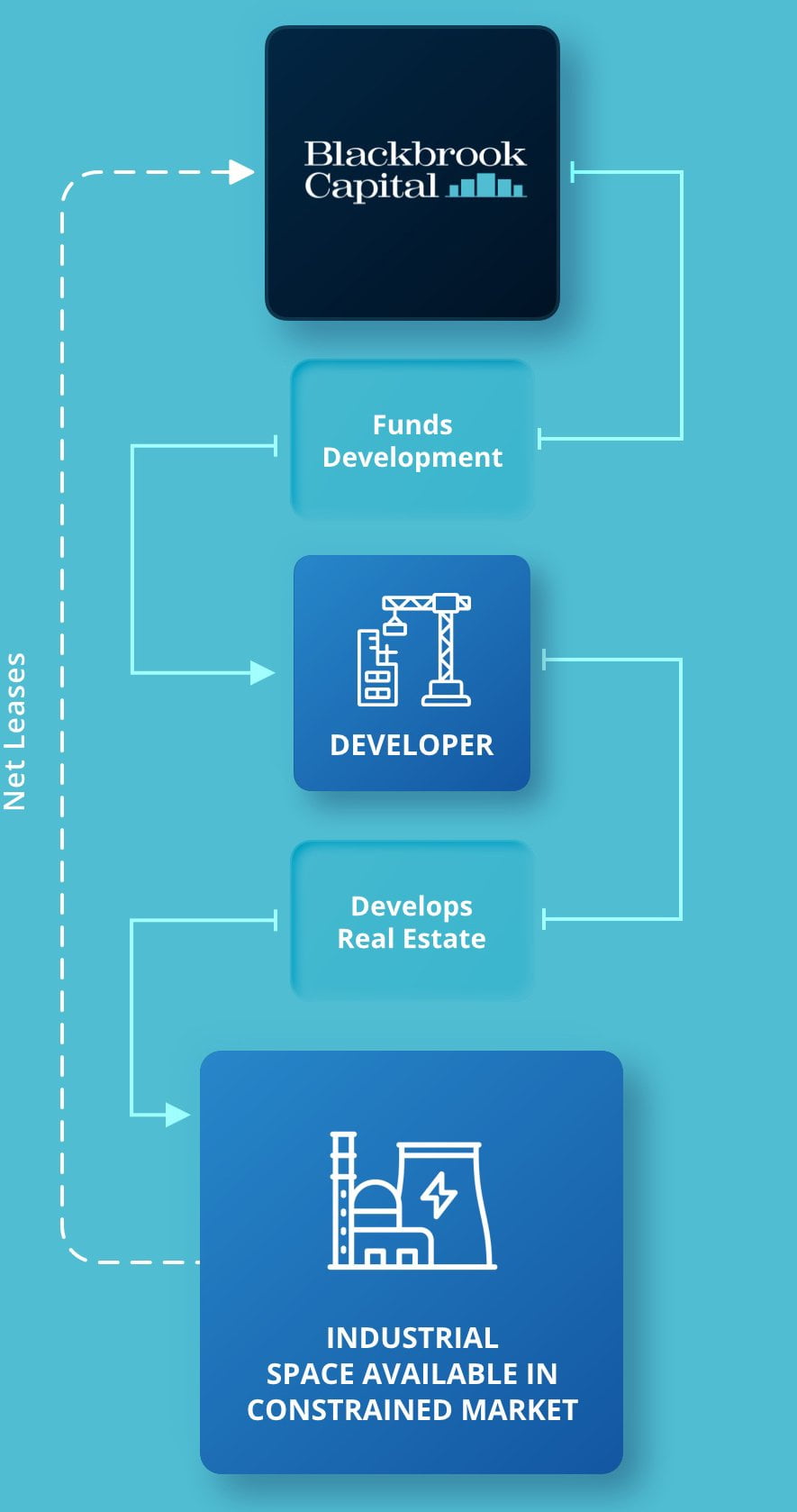

Development

Creating the supply chain infrastructure of tomorrow

Blackbrook partners with local and international developers to fund the construction of modern ESG-certified industrial & logistics assets on both a Speculative and Build-to-Suit basis, to meet future supply chain demands. With global pressure on supply chains, the availability of industrial & logistics facilities is limited.

We help alleviate these pressures by providing modern, flexible and ESG-optimised supply chain real estate in and around major urban conurbations in Europe.

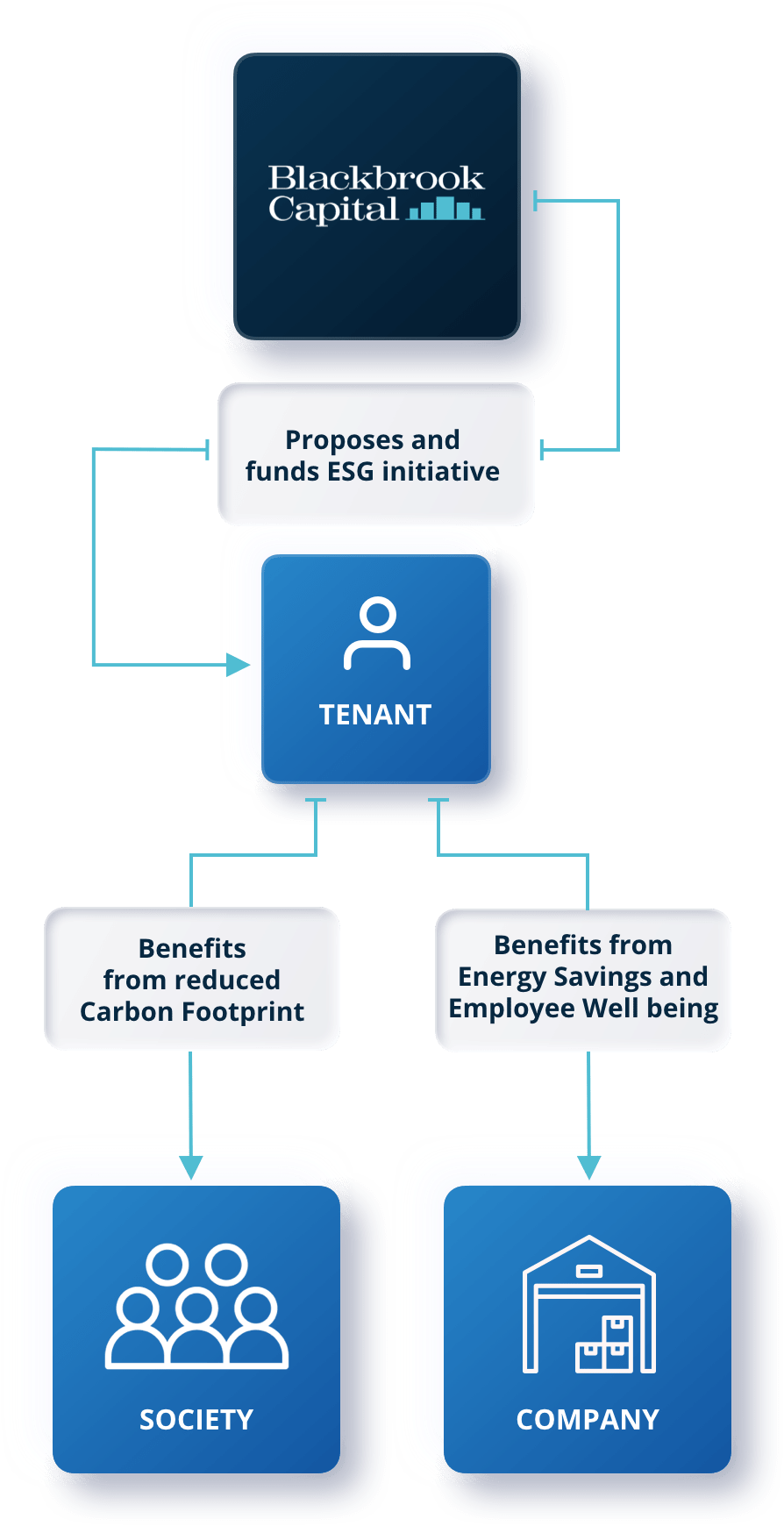

ESG

Creating the sustainable real estate of the future

The majority of investments by Blackbrook are ESG-certified and at the forefront of energy efficiency. Development assets typically benefit from net zero carbon construction, employee well-being amenities as well as local community considerations.

However, a substantial portion of commercial real estate is made up of functional legacy assets which can be ESG optimised without requiring reconstruction. We advise and provide capital for occupiers to reduce their carbon footprint on our portfolio assets.

Blackbrook is committed to having a fully ESG optimised portfolio. Our team is constantly and proactively working on ensuring that our ESG investments will create a meaningful and real impact for the long-run.